In recent years, the Federal Reserve’s decisions regarding interest rate cuts have captured the attention of economists, investors, and everyday consumers alike. These decisions have far-reaching effects on everything from mortgage rates to savings accounts. As the economy faces challenges in 2024, all eyes are on the Federal Reserve’s interest rate policies, especially in light of recent meetings and announcements. But what do these rate cuts mean for the economy, and how do they affect your finances?

With keywords like “Fed rate cut,” “interest rates today,” and “Jerome Powell” becoming increasingly popular, it’s crucial to understand the significance of these decisions and how they impact various sectors. Whether you’re wondering if the Fed will cut rates or trying to anticipate changes in the “10-year Treasury yield,” this guide will dive deep into everything you need to know.

What Are Federal Reserve Rate Cuts, and Why Do They Matter?

Understanding the Basics of Interest Rate Cuts

The Federal Reserve, also known as “the Fed,” plays a pivotal role in managing the U.S. economy. One of its key tools is adjusting the “Federal Funds Rate,” the interest rate banks charge each other for overnight loans. When the Fed “cuts rates,” it essentially makes borrowing cheaper. These decisions often come after meetings, such as the Federal Open Market Committee (FOMC) gatherings.

How Rate Cuts Influence the Economy

The Fed reduces interest rates to stimulate economic growth during downturns or when inflation is under control. Lower rates encourage businesses to borrow more, invest in expansion, and hire workers. Similarly, consumers benefit from reduced interest rates on “auto loans,” mortgages, and credit cards. The “prime rate today” directly reflects these cuts, influencing borrowing costs across the board.

Why the 10-Year Treasury Yield Matters

Understanding the 10-year Treasury yield is crucial for anticipating long-term interest rate trends. Discover how this key metric impacts your financial future in this detailed analysis from CNBC.

Impact of Fed Rate Cuts on Borrowers and Lenders

How Borrowers Benefit from Fed Rate Cuts

One of the most immediate impacts of Fed rate cuts is on borrowers. When the Fed lowers interest rates, it reduces the cost of borrowing, whether you’re financing a car, home, or business. If you’re looking at “auto loan rates” or considering refinancing your mortgage, the “fed interest rate” can significantly impact how much you pay over the life of your loan.

Borrowers with variable-rate loans, such as adjustable-rate mortgages (ARMs), feel these changes even more. As the “federal funds rate” declines, so do the rates on these loans, leading to lower monthly payments. This can save consumers thousands of dollars over time, making it one of the biggest advantages of a Fed rate cut.

The Effect on Savings and Investments

However, while borrowers may rejoice, savers face challenges when the Fed cuts rates. “CD rates today” and savings account yields tend to drop in tandem with the Fed’s actions. This makes it harder for conservative investors to find low-risk, high-yield savings options. The “prime interest rate” decline typically reduces the returns on fixed-income investments, affecting retirees and those relying on interest income.

Investors should also consider how Fed rate cuts influence stock and bond markets. A lower “federal reserve interest rate” often boosts stock prices, as lower borrowing costs fuel business growth. Meanwhile, bond prices typically rise when yields fall, meaning bondholders might see increased capital gains during periods of rate cuts.

The Federal Reserve’s Recent Rate Cut Announcements: A Look at 2024

Key Highlights from the Latest Fed Meeting

The Federal Reserve’s 2024 interest rate cuts have a profound effect on the economy, influencing everything from mortgage rates to investments. Read more on the Fed’s latest decisions in this Federal Reserve press release.

Powell’s statements during his “speech today” emphasized the Fed’s focus on maintaining economic stability while ensuring inflation does not rise too quickly. The decision on whether to “cut interest rates” was seen as a balancing act between supporting economic growth and keeping inflation in check.

How Does the Fed’s Dot Plot Influence Future Rate Cuts?

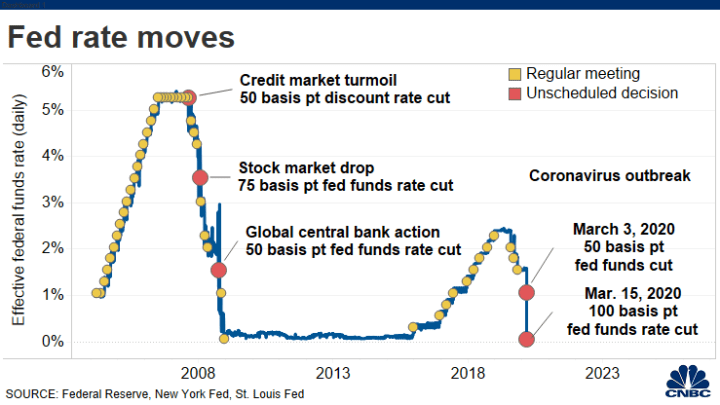

Another important aspect of the Fed’s decision-making process is the “dot plot,” which represents FOMC members’ projections for future interest rates. The dot plot released after the recent meeting showed that several members are considering additional cuts in 2024, with a focus on supporting the labor market and ensuring sustainable growth.

While no immediate changes were announced, the market is already pricing in the likelihood of future rate cuts. Speculation about whether the Fed will enact a “50 bps” cut or smaller adjustments continues, keeping investors on high alert for the next “fomc meeting.”

How to Prepare for Future Fed Rate Decisions

Monitoring Fed Announcements and Meetings

If you’re trying to stay ahead of the curve regarding Fed rate cuts, it’s essential to keep track of “fed meeting time” and upcoming announcements. Key events such as the “FOMC meeting” can provide valuable insights into future rate changes. Websites like “Yahoo Finance” and live updates from the Fed press conferences are excellent resources for real-time information.

Be sure to watch for updates on the “federal interest rate cut” and Powell’s “speech today,” as they often signal upcoming changes in the Fed’s policy. Whether the Fed decides to implement another “rate cut today” or waits until the next quarter, being informed will help you make smarter financial decisions.

Planning for Rate Cuts in Your Financial Strategy

As you prepare for future Fed rate cuts, it’s crucial to consider how these decisions will affect your overall financial strategy. If you’re a borrower, lower rates may be an excellent opportunity to refinance or lock in a fixed rate for the long term. However, if you’re a saver, you might want to explore higher-yielding options, such as stocks or real estate, which tend to perform better during periods of lower interest rates.

Additionally, if you’re investing in bonds, keep an eye on the “10-year Treasury” and other long-term yields, as they often react to Fed decisions. Understanding how the “federal funds rate” impacts different asset classes will help you make more informed investment decisions in the coming months.

Conclusion: Navigating the Future of Fed Rate Cuts in 2024

In 2024, the Federal Reserve’s decisions on interest rates will continue to play a pivotal role in shaping the U.S. economy. With rate cuts likely on the horizon, it’s crucial to stay informed about upcoming “fomc meeting” announcements, as well as the overall direction of the “federal reserve.”

Whether you’re a borrower looking for the best loan rates or an investor seeking opportunities in the stock and bond markets, understanding the intricacies of the Fed’s rate cuts can give you a competitive edge. By monitoring key indicators like the “10-year Treasury yield” and keeping up with Powell’s latest statements, you can make smart, timely financial decisions.